RBI Compliant Partners

Better Forex Rates

All Documents in One Place

Receive More Money, Faster!

Receive export payments from your international clients,without chasing your bank

- Fast Settlement

- Better Forex Rates

- Lower fees

- 24H Settlements

- 0% Forex Markup

- Lower Fees Than Banks

Receive International Payments

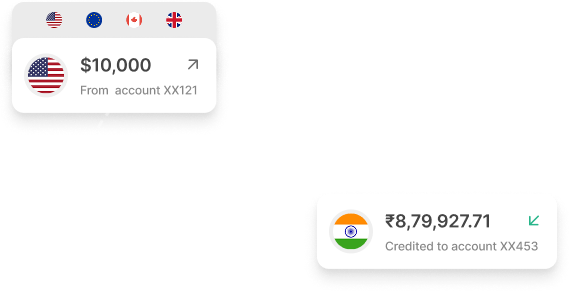

Client sends you

Add Your Heading Text Here

Live FX Rate:

You will receive

Earn 3% more than banks

87,207

Disclaimer

Start receiving

money in minutes,

secure and instantly accessible.

Send an Invoice to Your Buyer

With virtual account details

Buyer Remits to Virtual Account

Just like a local account

Track the transfer

Transparency at every step

Receive funds

Within 24 hours!

Why Choose Us? Simple.

Secure. Smart.

Why Choose Us?

Simple. Secure.

Smart.

Easily Receive international payments in India without banking hassles.

Get paid faster, transparently, and at better rates.

Easily Receive international payments in India without banking hassles.

Get paid faster, transparently, and at better rates.

Fast, Reliable, and Secure

International Payments

Receive money from 25+ currencies and 150+

countries within 24 hours

Fast, Reliable, and Secure

International Payments

Receive money from 25+ currencies and 150+countries within 24 hours

All you need for compliance,

including e-BRC and e-FIRA

All payments are compliant by default, with bank and DGFT approved e-BRC and e-FIRA generation

All you need for compliance,

including e-BRC and e-FIRA

All payments are compliant by default, with bank and

DGFT approved e-BRC and e-FIRA generation

All your docs in one

place. Zero headaches.

Everything in one secure place, making compliance

faster for you, your bank, and your CA.

All your docs in one place. Zero headaches.

Everything in one secure place, making compliance

faster for you, your bank, and your CA.

All your docs in one place. Zero headaches.

Everything in one secure place, making compliance

faster for you, your bank, and your CA.

Get Up and

Running, For Free

Start With Free Global Account for Exporters

Know Where

Your Money Is

Automatically match every payment

to its corresponding invoice

As an exporter, I used to struggle with delayed payments and hidden charges which disturb the cycle. With HiWiPay EXIM, I get my money in INR within a day and all documents are in place. It saves me time and cost.

Rajesh Kumar

MSME Leather Exporter

Rajesh Kumar

MSME Leather Exporter

I'm a digital content freelancer, most platforms charge high fees when I get paid by my clients. With HiWiPay, the charges are transparent and I receive more in hand which allows me to save more. Plus, the process is super quick.

Ria Sharma

Freelancer (Digital Content freelancer)

Ria Sharma

Freelancer (digital Content freelancer)

Our Partners

Looking to Simplify Your Global Payment Process?

Our team of international payment experts is ready to help you streamline your payment processes and expand your global reach.

-

Invoicing

Generate and manage invoices for international B2B payments. -

Payments

Securely process and receive international payments without delays. -

Export Documentation

Securely store important records, including invoices, Shipping bill, e-FIRA Packing List, e-BRC ensuring compliance with global financial regulations.

Frequently Asked

Questions

Manage money, reach goals. Simple tools, expert guidance.

Frequently Asked

Questions

Manage money, reach goals. Simple tools, expert guidance.

How can I receive international payments in India?

You can open a free global multi-currency account with HiWiPay, And start receiving export payments from 25+ currencies and 150+ countries directly into your Indian bank account.

How long does it take to receive you're international payments in India?

Is there a setup fee for a HiWiPay account?

How Can a Freelancer Receive International Payments in India?

What is FIRA, and how do I get it?

FIRA (Foreign Inward Remittance Advice) is an official document issued by a bank confirming the receipt of foreign currency into your account. It serves as proof that an international payment has been received, as is often required for:

- Regulatory compliance

- Tax filings

- Claiming export incentives

- Accounting and audit purposes

How can I receive international payments in India?

You can open a free global multi-currency account with HiWiPay, And start receiving export payments from 25+ currencies and 150+ countries directly into your Indian bank account.

How long does it take to receive you're international payments in India?

With HiWiPay, exporters typically receive payments within 24 hours.

Is there a setup fee for a HiWiPay account?

How Can a Freelancer Receive International Payments in India?

Is there a setup fee for a HiWiPay account?

Answer

Are my export payments secure with HiWiPay?

What are Virtual Accounts, and how do they help in receiving payments

A virtual account is a unique bank account number assigned to a business to collect and track payments efficiently. It is a reference for incoming funds linked to a master account.

Virtual accounts make receiving and managing payments easier by providing a unique bank account number for each transaction, customer, or business need. They are linked to a main bank account but act as separate identifiers, making tracking and reconciliation more efficient.

What is FIRA, and how do I get it?

FIRA (Foreign Inward Remittance Advice) is an official document issued by a bank confirming the receipt of foreign currency into your account. It serves as proof that an international payment has been received, as is often required for:

- Regulatory compliance

- Tax filings

- Claiming export incentives

- Accounting and audit purposes

Can I generate e-BRC through HiWiPay?

Yes, you can generate an e-BRC (electronic bank realization certificate) through HiWiPay portal. An e-BRC is an important document for exporters, as it serves as proof of foreign exchange realization and is required to claim export incentives under various government schemes.

To generate e-BRC, follow these steps.

Sign in to HiWiPay >> Click Start Shipment menu >> Click View or Edit button against invoice >> Check e-BRC tab >>

What is FEMA?

What is the payment settlement time?

The payment settlement time is less than 24 hours. Once the transaction is processed, the funds will be settled within a day.

How do I sign up for HiWiPay?

Signing up for HiWiPay is quick and easy with our self-onboarding feature:

- Register with your email ID

- Complete the onboarding process

- Get notified once your account is successfully activated

Need help? Reach out to us exim@hiwipay.com for assistance