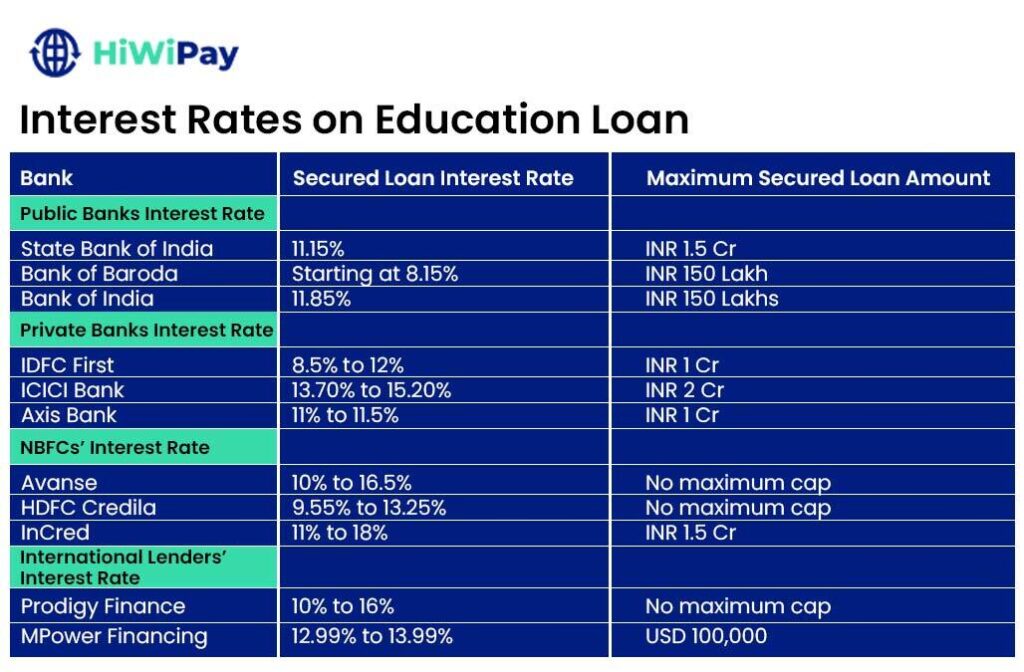

Top Banking Institutions and Their Interest Rates

Public Banks’ Interest Rate

| Bank | Secured Loan Interest Rate | Maximum Secured Loan Amount | Unsecured Loan Interest Rate | Maximum Unsecured Loan Amount |

| State Bank of India (SBI) | 11.15% | INR 1.5 Cr | 11.15% | INR 7.50 Lakhs |

| Bank of Baroda | Starting at 8.15% | INR 150 Lakh | NA | NA |

| Bank of India | 11.85% | INR 150 Lakhs | NA | NA |

Private Banks’ Interest Rate

| Bank | Secured Loan Interest Rate | Maximum Secured Loan Amount | Unsecured Loan Interest Rate | Maximum Unsecured Loan Amount |

| IDFC First | 8.5% to 12% | INR 1 Cr | 10.50% to 12.50% | INR 50 Lakhs |

| ICICI Bank | 13.70% to 15.20% | INR 2 Cr | 9.85% to 15.50% | INR 1 Cr |

| Axis Bank | 11% to 11.5% | INR 1 Cr | 13.70% to 15.20% | INR 50 Lakhs |

NBFCs’ Interest Rate

| NBFCs | Secured Loan Interest Rate | Maximum Secured Loan Amount | Unsecured Loan Interest Rate | Maximum Unsecured Loan Amount |

| Avanse | 10% to 16.5% | No maximum cap | 10% to 16.5% | INR 60 to 75 Lakhs |

| HDFC Credila | 9.55% to 13.25% | No maximum cap | 9.55% to 13.25% | INR 45 Lakhs |

| InCred | 11% to 18% | INR 1.5 Cr | 11% to 18% | INR 60 Lakhs |

International Lenders Interest Rate

| International Lenders | Secured Loan Interest Rate | Maximum Secured Loan Amount | Unsecured Loan Interest Rate | Maximum Unsecured Loan Amount |

| Prodigy Finance | 10% to 16% | No maximum cap | 10.5% to 16% | USD 2,000 |

| MPower Financing | 12.99% to 13.99% | USD 100,000 | 12.99% to 13.99% | NA |

Types of Interest Rates in Study Abroad Loans

- Fixed Interest Rate: With this type, your interest rate stays the same for the entire loan period, giving you consistent monthly payments. It is great if you like knowing exactly what to expect and want to budget easily.

- Floating Interest Rate: Here, your interest rate can change depending on market conditions and reference rates like MCLR or Repo Rate. This means your payments might go up or down over time.

Factors that Affect Study Abroad Interest Rates

Interest rates for study-abroad loans can vary based on several factors:

- Loan Amount: The more you borrow, the higher the interest rate tends to be.

- University/Course Selection: Some lenders offer better rates for reputable universities or popular courses.

- Collateral: Secured loans, backed by collateral, usually have lower interest rates than unsecured ones.

- Repayment Period: Longer repayment terms often mean higher interest rates.

- Credit Score: Lenders assess your credit score, income, and financial stability. Higher scores and stable incomes usually result in lower rates.

- Co-signer/Guarantor: If you lack a borrowing history, you may need a co-signer who meets the lender’s criteria.

- Loan Type: Whether the loan is federal or private can also affect the interest rate.

EMI on Education Loans – How to Calculate?

For anyone considering studying abroad, understanding education loan interest rates and EMIs is essential. Now, calculating the EMI for your loan involves factoring in several details about the loan, like the loan amount, interest rate, loan period, course duration, moratorium period, and payment during the moratorium. Calculating the EMI amount using these numbers might seem overwhelming, so we have a better option for you: your support system, HiWiPay. All you need to do is enter the figures for the details given, and it will tell you how much you need to pay each month!

Advantages of Education Loan

Education Loans have some great perks for students looking to further their education, especially abroad. Here is why:

- Easing your financial burden: They ease the burden on your family savings and spare you from having to cash out investments like fixed deposits, mutual funds, or bonds.

- Tax benefits: As per the Income Tax Act, you can get a tax rebate on the interest paid for your education loan for upto 8 years.

- Delayed Payments: You only start paying back the loan after you finish your studies, giving you breathing room to focus on your education first.

- Comprehensive Coverage: These loans don’t just cover tuition fees; they also include living expenses, travel costs, study materials, laptops, and more.

- Flexible Repayment Options: Many banks offer reasonable interest rates, especially for prestigious universities, and provide flexible repayment terms.

- Credit History Building: Taking out an education loan empowers students to finance their education independently, which also helps them establish a credit history as they repay the loan.

Eligibility Criteria for Education Loan

The following are the general requirements; however, these may differ from bank to bank.

- The candidate should be an Indian National

- Age should be up to 35 years (non-employed individuals) and up to 45 years (employed individuals)

- Proof of admission

- Valid educational certificates (academic record of more than 50% marks)

- Co-applicant’s (Parent or guardian) credit history or income proof

- Passport/i20 form/visa

Documents Required for Education Loan to Study Abroad

To apply for the loan, you’ll need:

- Proof of identity and address for the student or co-signer (like a driver’s license, passport, or Aadhaar card).

- A copy of the passport.

- Two passport-size photos of the applicant or co-signer.

- Academic records, including mark sheets for 10th, 12th, and graduation, as well as entrance exam results.

- Proof of admission, such as an offer letter, admission letter, or ID card (if available).

- Financial documents like bank statements, income tax returns, and any other relevant financial records.

- Copies of collateral documents.

- A demand letter from the college or university.

- Form A2 signed by the applicant or co-signer.

How to Apply for Education Loan?

Once you have got all the documents you need, it is time to apply for the loan. Here’s what you do:

- Got to the bank’s website.

- Fill out the application online with your personal info and details about the loan you need.

- Submit the application along with all the required documents.

- The bank will then check everything over to make sure you qualify.

- If you are approved, they will send the money straight to your college or university or to you.

Keep in mind that the exact steps might vary depending on which bank or financial institution you are dealing with.

Frequently Asked Questions

For which type of courses, do banks offer education loans for studying abroad?

Banks offer education loans for studying abroad, covering a wide range of courses like MS, MBA, MBBS/MD (only in Indian colleges), executive management programs, and others. HDFC Bank provides loans for over 2100 universities and 950 courses in 35+ countries, while SBI offers loans for degrees and diplomas in disciplines offered by foreign institutes in countries like the USA, UK, Canada, Australia, Singapore, Japan, Hong Kong, New Zealand, and Europe.

Which is the best bank to receive an education loan for studying abroad?

When considering which bank is the best for an education loan for studying abroad, it is crucial to look beyond just the interest rates. Consider the following factors:

1.Eligibility criteria

2. Courses for which the loan is applicable

3. Collateral required, if any

4. Co-signer/Guarantor required

5. Margin amount

6. Interest rate

7. Loan amount

8. Repayment tenure

9. Moratorium Period

10.Credit score

Can I get the total cost of studying abroad as an education loan?

Yes, you can get an education loan that covers the total cost of studying abroad. Here’s what it usually covers:

1. Tuition fees

2. Living and hostel expenses

3. Travelling expenses

4. Examination fees

5. Library/laboratory fees

6. Books/equipment/instruments/uniforms

7. Computers/laptops (only if necessary for completion of the course)

References:

Works Cited

“Abroad Education Loan Interest Rate of Different Lenders.” Elanloans.com, www.elanloans.com/blogs/overseas-education-loan-interest-rate-comparison. Accessed 29 Apr. 2024.

Anumika Bahukhandi. “Education Loan for Studying Abroad: Top Loan Providers, Interest, Eligibility, Documents & Process.” Shiksha.com, Shiksha Study Abroad, 25 July 2018, www.shiksha.com/studyabroad/education-loan-applycontent61319. Accessed 29 Apr. 2024.

“Apply Education Loan for Abroad Studies | IDFC FIRST Bank.” Www.idfcfirstbank.com, www.idfcfirstbank.com/personal-banking/loans/education-loan/education-loan-for-abroad-studies. Accessed 29 Apr. 2024.

“Baroda Scholar.” Www.bankofbaroda.in, www.bankofbaroda.in/personal-banking/loans/education-loan/baroda-scholar. Accessed 29 Apr. 2024.

“Education Loan for Abroad Studies | HDFC Credila.” Hdfccredila.com, hdfccredila.com/abroad/loan-for-study-abroad.html. Accessed 29 Apr. 2024.

“Education Loan Scheme – Interest Rates.” Www.sbi.co.in, www.sbi.co.in/web/interest-rates/interest-rates/loan-schemes-interest-rates/education-loan-scheme. Accessed 29 Apr. 2024.

“Education Loan to Study Abroad | Avanse Financial Services.” Www.avanse.com, www.avanse.com/education-loan/study-abroad-loan. Accessed 29 Apr. 2024.

“Education Loan: Apply for Student Loan Online | ICICI Bank.” Www.icicibank.com, www.icicibank.com/personal-banking/loans/education-loan. Accessed 29 Apr. 2024.

“Get a Loan to Study Abroad in the US | Prodigy Finance.” Prodigyfinance.com, prodigyfinance.com/resources/blog/choose-best-study-abroad-loan/. Accessed 29 Apr. 2024.

MPOWER. “Understanding Study Abroad Education Loans.” MPOWER Financing, www.mpowerfinancing.com/financial-empowerment/study-abroad-education-loan. Accessed 29 Apr. 2024.

“Non-Collateral Education Loan for Abroad Studies | Axis Bank.” Www.axisbank.com, www.axisbank.com/progress-with-us-articles/how-to-get-education-loan-for-abroad-studies-without-collateral. Accessed 29 Apr. 2024.

“Star Education Loan | Study in Abroad | Interest Rate.” BOI, bankofindia.co.in/education-loan/star-education-loan-studies-abroad. Accessed 29 Apr. 2024.

Sukhtankar, Namrata. “Avanse Education Loan: Collateral & Interest Rate [Detailed Guide].” UniCreds, 6 Dec. 2023, unicreds.com/blog/avanse-education-loan. Accessed 29 Apr. 2024.