Do you fear that your child might not have enough money to live as an international student in Canada? The fear and uncertainty can compel you to transfer money to your child. After all, they might need it at any point, and you don’t want them to suffer out there, do you? Just like you, we don’t want you to suffer either. So, in this blog, we will tell you everything you must consider before safely transferring money from India to Canada. We will cover everything from the major expenses to making the right choice out of all the different money transfer methods to opening a Canadian bank account.

Transfer Money From India to Canada for International Students: Table Of Content

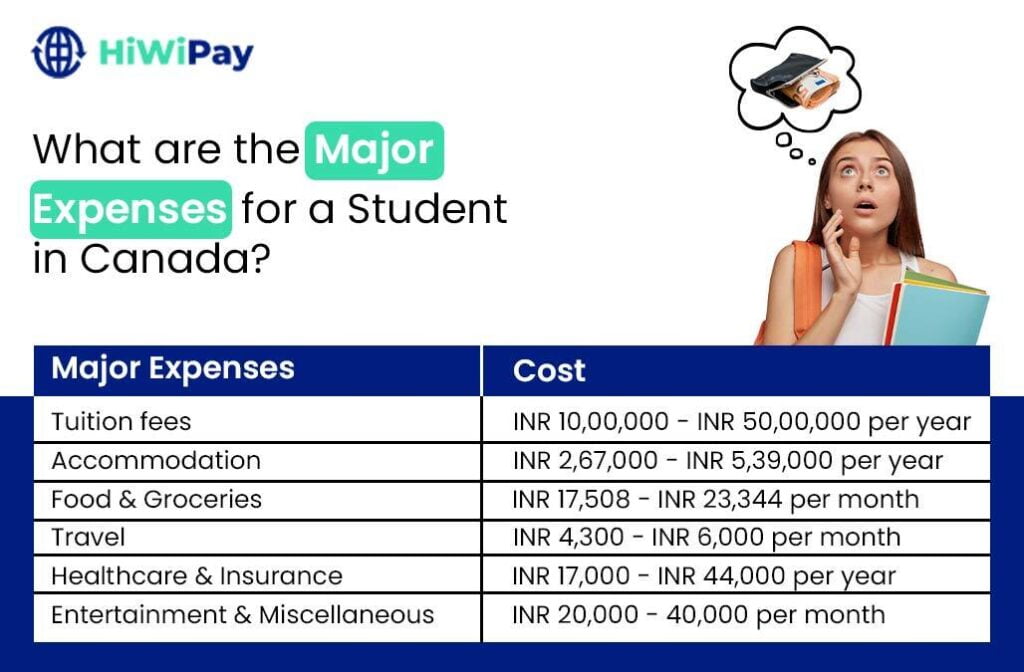

What are the Major Expenses for a Student in Canada?

The first thing you need to know is the major expenses for a student in Canada. However, you must understand that several factors, such as the chosen city and your child’s lifestyle, influence money requirements.

So, while the specific numbers may vary, here is an overview of the cost of living in Canada for an international student:

Note: The figures mentioned in the table are approximate. They may vary by location and currency exchange rate. Last updated on 12/03/24.

Knowing about the major expenses can help to create a financial budget and transfer money to Canada so your child can live stress-free there.

What are the different ways of transferring money from India to Canada for Students?

When it comes to transferring money from India to Canada, you have several options to choose from like:

1. Banks

One of the most reliable and well-tested methods for transferring money abroad is through banks. These established financial institutions, such as ICICI Bank, SBI, or Kotak Mahindra Bank, provide a sense of security as they operate under strict RBI and other regulations, ensuring compliance with legal requirements.

As per the Liberalised Remittance Scheme (LRS) regulations, you can send up to USD 250,000 (INR 20,682,750) per financial year (April-March). Indian residents must pay a 5% tax on remittances above INR 700,000. However, funds sent for medical or educational purposes are subject to a 20% tax. Also, you must have a Permanent Account Number (PAN) to send money.

Banks offer a completely digital process for you to transfer money. Here are some methods they offer:

1.1 Debit Card or Credit Card

Most banks in India allow international payments through your debit or credit cards. Their partnership with companies like Visa, Mastercard, Amex, etc, helps the process. However, you must activate this feature on your card to use it in person or online.

To make the transfer, you will need the beneficiary’s details (Name, account number, address, country name, bank name, and recipient’s address), SWIFT Code, and transit number.

The minimum and maximum amounts for sending money may vary based on the bank’s policies. For instance, ICICI Bank allows you to send INR 20 lakhs daily, but HDFC Bank allows you to send INR 7,44,462 daily. The time taken to make these transfers varies from 2 to 5 days, depending on the bank.

The charges applicable also vary from bank to bank. For instance, ICICI Bank charges:

- Markup fee – 3.5% + Goods and Services Tax (GST)

- ATM Cash Withdrawal Fee overseas – Rs. 125 + GST

- Balance Enquiry overseas – Rs. 25 + GST

1.2 Multi-Currency Accounts

Multi-currency accounts can make it cheaper and more convenient to spend internationally. While there are no specific percentage fees for using multi-currency accounts, you must consider the overall costs, including exchange rates and transaction fees. To open a multi-currency account, you will typically need identification documents such as a passport, proof of address, and other relevant paperwork.

If you are going with multi-currency accounts, be sure to keep a close eye on exchange rate fluctuations based on market conditions. This way, you can convert when rates are in your favour.

1.3 Wire Transfer

Wire transfers are a form of electronic funds transfer (ETF) that travel through banks. If you have a savings account, you can transfer money from India through a SWIFT transfer.

You will need the beneficiary’s bank account number, bank name, bank SWIFT code, bank address, and bank transit code. You can securely transfer money via this method within 1-3 working days. However, the exact time may vary based on the bank and the specific transfer details.

The charges for wire transfers from India to Canada vary from bank to bank. For instance, ICICI charges INR 750 for resident customers and INR 500 for NRI customers.

1.4 Foreign Currency Bank Draft (Cashier’s Cheque)

If you don’t trust online platforms for money transfers from India to Canada, banks offer you another option: a foreign currency bank draft. All you need to do is go to the bank, fill out the form and give it to the bank for further processing. You may also have to submit a signed indemnity letter or deposit slip.

Depending on the bank, a minimum amount may be required to draw this cheque. For Canada, it is usually CAD 10 if you have a savings account and CAD 300 if you have a current account. The amount might be credited within 1-21 international working days. The bank will also charge INR 250 to NRI or domestic customers for collection arrangements.

1.5 Forex Cards

Many banks, like ICICI, HDFC, etc., offer forex cards. With this card, you can load money for your child before they even land in Canada. The most significant advantage of having it is that there is no charge for transferring money. However, there are minimal charges for ATM withdrawals. Additionally, with a Forex card, you can lock in the exchange rate when loading, protecting against fluctuations. So, you must closely monitor the exchange rate when loading.

2. Local agents

Local agents can facilitate money transfers from India to Canada. Agents like Western Union, Ria Money Transfer, etc., can help with in-person assistance, verification and documentation, cash payout, bank account transfers, exchange rate information, and security and encryption. These agents usually offer both sending money to someone’s bank account and cash pickup.

When choosing a local agent, you must be careful as not all of them might be reliable, authorised, and comply with the relevant regulations. So, if the local agent is India-based, check if they are registered with the Reserve Bank of India (RBI) and if they have any certifications or licenses displayed at their office or on their website. Be sure to ask for their credentials and research online for reviews and feedback.

To send money through your chosen local agent, you must register with them, enter the amount, country, and the receiver’s account number, address, and contact information. Then select your payment method: bank transfer, credit or debit card. Then, enter your details. After making the payment, you will receive an email with your tracking number so that you can monitor the progress of your Indian money transfer to Canada. It usually takes 3-4 business days for the transfer to go through.

There is no minimum or maximum amount per transaction, but the local agents must follow the Liberalised Remittance Scheme (LRS) regulations, so you can only send up to USD 250,000 (INR 20,682,750) per financial year (April-March).

When it comes to taxes, exchange rates, and transfer fees, the local agents usually have a price estimator tool that can clarify the situation.

3. Online Remittance Companies

Several online remittance companies, like Wise, HiWiPay, etc., can help you transfer money from India to Canada. They offer various payment methods, such as bank transfer (ACH or SWIFT), debit or credit card, bank draft, or international money orders.

When choosing, choose a company that offers transparency, competitive rates, and efficient processes. Do check if they have any certifications or licenses and their reviews online.

To transfer money, you must enter your foreign currency amount and fill out the student details with the student KYC. Then, fill out the beneficiary account details, address, KYC and contact information. Next, digitally sign the A2 form and confirm the final amount in INR, including TCS, to generate the challan. Finally, make a payment to the mentioned bank account via physical payment to your own bank or net banking. It usually takes 24 to 48 hours for the transfer to go through, much faster than banks or local agents.

These companies tend to have an online platform, either an app or a website, from which you can set up transfers, track progress, and manage your account. They do have a minimum amount ranging from INR 100 to INR 1000. However, the maximum amount remains the same: USD 250,000 (INR 20,682,750) per financial year (April-March), as set by the Liberalised Remittance Scheme (LRS).

Online remittance companies usually charge 1% to 2% markup fees and transaction fees. They usually have a calculator available on their site or app that can show the breakdown of these amounts and how much the recipient will get.

Choose the Right Transfer Method

Now that you know about the different transfer methods available, you must assess their differences to select the most suitable one for your needs. Have a look at the table below for a brief overview of the factors you must consider:

| Transfer method | Digital Process | Minimum Amount | Maximum Amount | Exchange rate | Markup fees | Duration |

| Debit or Credit Card (Bank) | Yes | INR 800 per transaction | USD 250,000 per year | 1 CAD = 61 INR | 3.5% + 18% (GST) | 2-5 days |

| Multi-currency Accounts (Bank) | Yes | INR 800 per transaction | USD 250,000 per year | 1 CAD = 61 INR | N/A | N/A |

| Wire Transfer (Bank) | Yes | INR 800 per transaction | USD 250,000 per year | 1 CAD = 61 INR | N/A | 1-3 days |

| Foreign Currency Bank Draft (Bank) | Digital and physical both | INR 800 per transaction | USD 250,000 per year | 1 CAD = 61 INR | N/A | 1-21 days |

| Forex Card (Bank) | Digital | N/A | N/A | N/A | 2% | N/A |

| Local Agents | Digital and physical both | No minimum amount per transaction | USD 250,000 per year | 1 CAD = 61 INR | 1.7% | 3-4 days |

| Online Remittance Companies | Yes | INR 1000 per transaction | USD 250,000 per year | 1 CAD = 61 INR | 1% per transaction | 24 hours to 48 hours |

Note: The numbers mentioned in the table vary by bank, company, location and currency exchange rate. Last updated on 12/03/24.

Let’s explore the advantages and disadvantages of each of the abovementioned money transfer methods in detail.

Banks

The traditional money transfer method offers the following advantages:

- Reliability & Security: They are established financial institutions regulated by the Reserve Bank of India (RBI), offering you a sense of security for transferring any amount.

- Compliance with Regulations: They comply with the legal requirements, including the Liberalised Remittance Scheme (LRS) regulations, which govern international remittances from India, so you don’t have to worry.

- Multiple Transfer Options: Multiple transfer options are available, such as wire transfers, debit/credit card payments, forex cards, foreign currency bank drafts, and multi-currency accounts, giving you a choice.

The disadvantages follow closely behind:

- Higher Fees: Compared to other methods, banks impose higher fees, including markup fees, ATM withdrawal fees, and balance inquiry fees.

- Long Processing time: The transfer takes longer to complete, typically 2-5 days.

Local Agents

The local agents have their own advantages:

- In-person Assistance: Out of all the options, local agents are the only ones offering in-person assistance to make things easy.

- Cash Pickup Options: These agents facilitate cash pickup options, too, allowing your child access to funds.

The following are some of its disadvantages:

- Reliability Concern: Not all local agents may be reliable or authorised, posing fraud risks or non-compliance with regulations.

- Limited Transfer Options: The transfer options are limited compared to the other two methods.

Online Remittance Companies

The modern money transfer method offers these advantages:

- Transparency & Competitive Rates: They offer transparent fee structures and competitive exchange rates, providing cost-effective transfer options.

- Faster Processing Time: Compared to the other methods, this one offers faster transfers, completing transactions within 24 to 48 hours.

- Convenient Online Platform: These companies provide user-friendly online platforms, allowing customers to initiate and track transfers conveniently from anywhere, anytime.

Here are some of its disadvantages:

- Minimum Transfer Amount: They do have minimum transfer amounts (INR 100 to INR 1000), limiting flexibility for smaller transactions.

- Transaction Fees: Irrespective of the competitive rates, they may still charge 1% markup fees and transaction fees per transaction.

Make The Right Choice for You

So, banks are the way to go if you are looking for a secure and comfortable way with a slightly longer processing time to send money to your child studying in Canada. However, consider online remittance companies if you want quick and cost-effective transfers, especially for smaller amounts. But if personalised assistance is your priority, go for local agents for convenience.

Understand the Regulations and Requirements

For money transfers from India to Canada, you must understand the regulations and requirements governing international money transfers set forth by regulatory authorities in both countries. Understanding and following these regulations are crucial for a smooth transfer process.

In India, 3 main regulations govern money transfers: the Foreign Exchange Management Act (FEMA), the Reserve Bank of India’s (RBI) Liberalised Remittance Scheme (LRS), and the Indian Income Tax Act. The important regulatory bodies in Canada include the Financial Transactions and Reports Analysis Center of Canada (FINTRAC).

Documents Required:

To initiate an international money transfer from India to Canada, you must provide certain documents to comply with regulatory requirements, such as

- PAN Card Copy of the Remitter

- Duly Filled A2 Form cum Declaration

- KYC Documents like a passport or Aadhar Card

Restrictions and Limitations:

While LRS allows you to send money to your child in Canada for various purposes, there are certain restrictions and limitations that you must know about

- Annual Limit: The LRS imposes an annual limit on the amount of money that Indian residents can remit abroad. As mentioned earlier, the limit is set at USD 250,000 (INR 20,682,750) per financial year (April-March).

- Tax Implications: Depending on the purpose of the transfer and the amount remitted, students may be subject to taxation under Indian tax laws. For instance, remittances for educational purposes are subject to a 20% tax if the amount exceeds INR 700,000.

- Frequency of Transfers: There are no specific limits on the frequency of transfers.

Open a Canadian Bank Account

Opening a Canadian bank account is a crucial step for your child studying in Canada. Not only does it offer convenience and accessibility for managing finances, but it also facilitates receiving funds from India.

Steps to Open a New Bank Account in Canada for International Students

You can open a bank account online, or your child can open it in person. Here are the steps you need to follow:

- Gather Your Documents

You require 2 documents for identification. It can be a passport, study permit, or letter of acceptance.

- Select a Bank.

Consider the location, features, hours of operation and online banking features when you choose. After that, make an appointment to start the process.

- Choose Your Account Type

You can go for a chequing account for everyday transactions, a savings account for storing money, or a foreign currency account if you want to keep money in a different currency.

Remember to ask about terms, conditions, and transaction fees, as they vary between banks.

- Fill out the Application Form & Submit Documents

After choosing, take the application form, fill it out, and submit it with the bank-required documents.

- Verification & Approval

The bank will verify the documents and information provided before approving the account opening request.

- Gain Access to Your Account

After approval, you will receive your Canadian bank account details, a debit card, and a PIN (personal identification number) to gain access to your account from ATMs or debit machines.

Still trying to decide whether opening a new bank account in Canada is the right move?

Consider the benefits of using a local bank account, as given below:

- Reduced Transaction Cost: When using an international bank account for transactions, there are high currency conversion and international transfer fees. Having a local account allows your child to avoid these extra costs.

- Convenience: Your child can easily pay bills, rent, and purchase using local currency without worrying about exchange rates.

- Faster Access to Funds: Your child can receive payments from part-time jobs, scholarships, or family support directly into the local account, ensuring quick access.

- Avoid Currency Conversion Fees: Using it, your kid can avoid currency conversion fees when receiving funds in Canadian dollars and save money.

- Access to Student Benefits: Many Canadian banks offer specialised accounts and benefits for students, such as discounted or waived fees, overdraft protection, and student credit cards.

- Build Credit History: Opening a Canadian bank account allows your child to start building their credit history in Canada, which is good for them in the long run.

FAQs

How much does it cost to transfer money abroad?

The cost of transferring money abroad from India depends on various factors, such as the service provider, transfer method, amount, and currency. Banks usually charge 3.5% + 18% (GST) markup fees. Local agents charge 1.7% in markup fees. Lastly, the lowest among these is online remittance companies that charge 1%.

How much money can I send to Canada?

As per the Liberalised Remittance Scheme (LRS) regulations, you can send up to USD 250,000 (INR 20,682,750) per financial year (April-March). The minimum amount varies across transfer methods:

Banks – INR 800 per transaction

Local Agents – No minimum amount

Online Remittance Companies – INR 1000 per transaction

How are money transfer specialists and non-bank payment service providers different from banks?

While banks remain a traditional and trusted source of money transfers abroad, they do charge higher fees, are less transparent, and take 2-5 days for the transfer to go through.

On the other hand, money transfer specialists and non-bank payment service providers are licensed entities that provide payment services but do not operate as full-fledged banks. They are much more cost-effective, transparent, and faster than banks, taking only 24 to 72 hours to complete the transaction.

Important things to consider when choosing how to transfer your money:

Consider the following when choosing how to transfer your money:

- Authority & Reliability

- Exchange Rate

- Transfer Security

- Fees and Charges

- Tax

- Convenience

- Minimum & Maximum Amount

- Transfer Speed

- Customer Service

Is sending money to Canada taxable?

Yes, sending money to Canada is taxable as per the Liberalised Remittance Scheme (LRS). Indian residents must pay a 5% tax on remittances above INR 700,000. However, funds sent for medical or educational purposes are subject to a 20% tax.

What is swift code?

It is a unique alphanumeric code assigned to financial institutions worldwide. It helps identify financial institutions during international transactions through its own SWIFT code, which consists of 8 to 11 characters. It indicated the institution’s name, location, and branch.

What are the documents required to transfer money to Canada?

The documents required are:

- PAN Card Copy of the Remitter

- Duly Filled A2 Form cum Declaration

- KYC Documents like a passport or Aadhar Card

- Beneficiary details like name, address, account number and country

- Swift Code

How long does it take to send money from India to Canada?

The time taken varies, depending on the transfer method.

Banks: 2-5 days

Local Agents: 3-4 days

Online Remittance Companies: 24 – 48 hours

References

“How to Transfer Money from India to Canada?” Send Money to Canada From India Online – Axis Bank, www.axisbank.com/retail/forex/international-fund-transfer/remit-money-canada. Accessed 19 Mar. 2024.

“How to Transfer Money from India to Canada?” Send Money to Canada From India Online – Axis Bank, www.axisbank.com/retail/forex/international-fund-transfer/remit-money-canada. Accessed 19 Mar. 2024.

“How to Transfer Money from India to Canada?” Send Money to Canada From India Online – Axis Bank, www.axisbank.com/retail/forex/international-fund-transfer/remit-money-canada. Accessed 19 Mar. 2024.

Reserve Bank of India – Frequently Asked Questions, www.rbi.org.in/Scripts/FAQView.aspx?Id=115#Q1. Accessed 19 Mar. 2024.

Saket Kohli An International Higher Ed professional with 7+ years of experience studying, et al. “Average Cost of Living in Canada for Indian Students [2024 Updated].” Leap Scholar, 9 Jan. 2024, leapscholar.com/blog/average-cost-of-living-in-canada-for-indian-students/.

Sonal. “Cost of Studying in Canada: A Guide.” Leverage Edu, 12 Jan. 2024, leverageedu.com/blog/cost-of-studying-in-canada/.