Education Loan For Pilot Training In Abroad Key Features

A commercial pilot’s license from an approved flight school ranges from INR 35 to 40 lakhs. Therefore, education loans for pilot training abroad are specifically designed to support students in covering the expenses associated with their aviation education. Here are some key features of these loans:

| Loan Parameters | Details |

| Loan Limit | Loan amount up to INR 1.5 Cr |

| Expenses Covered | Course tuition fees Hostel and meal expenses Cost of computer or laptop purchase Costs for instruments, uniforms, and equipment Expenses for books and stationeries Expenses for study projects, tours, and thesis work Travel expenses |

| Accepted Co-applicant | Parents-in-law, Parents, Spouse, Siblings |

| Interest Rates | Starts from 10.90% |

| Moratorium Period | Course timeline + 12 months |

| Repayment Duration | Can be extended maximum upto 15 years |

| Eligibility Criteria | Should be at least 17 years old.Completed 10+2 with a mandatory subject combination of Mathematics, Chemistry, and Physics.Result from a standardised test like TOEFL or IELTS. Pass the aviation-specific medical exam.To pursue studies in another country, you must obtain a visa.Show that you are capable of funding your education, living expenses and any other related costs. |

| Acceptable Collaterals | Life Insurance Corporation Policy, Fixed Deposit, Government bond or Immovable Property |

| Loan Margin | 10% of the loan amount |

Note: The details and numbers mentioned in the table vary by bank, company, location and currency exchange rate. Last updated on 03/05/24.

Types of Education Loans for Pilot Training

Education loans are available whether you are pursuing a diploma, certificate, skill-based course, graduation, or post graduation for pilot training. These loans can be obtained from various public and private sector banks and NBFCs (Non-Banking Financial Companies) in India. You can borrow up to INR 1.5 crore from public sector banks and INR 2 crore from private banks. The interest rate starts from 9.50% for domestic education loans and 10.90% for study-abroad education loans. However, the exact rate may vary.

Here are the several types of education loans available for pilot training, particularly for Indian students planning to study abroad:

- Domestic Education Loan: These education loans are for people who desire to pursue pilot training in India. It typically covers tuition fees, accommodation fees, and any other related expenses.

- Study Abroad Education Loan: If you want to get your pilot training from abroad, you can get a study abroad education loan. It covers course tuition fees, hostel and meal expenses, cost of computer or laptop purchase, costs for instruments, uniforms, and equipment, expenses for books and stationeries, expenses for study projects, tours, thesis work, and travel expenses.

- Undergraduate Education Loan: This type of education loan is specifically for people pursuing undergraduate degrees. It covers tuition fees, accommodation expenses, and other related expenses.

- Education Loans for Professionals and Graduates: You can get this type of loan if you are someone who wants to go for courses designed for working professionals or for post-graduation courses. It is typically used to cover the expenses associated with advanced degrees or professional certificate courses.

- Career Education Loan: If you desire to advance your career, then this loan is for you. It covers the cost of any programs that can help you learn a new skill or get a certificate.

Remember, the terms and conditions of these loans can vary based on the specific bank or financial institution offering the loan. So, do check with them to get accurate information.

Read More : How to Get Student Loan for MBA Abroad

Eligibility Criteria For Student Pilot Loan

Here are the eligibility criteria for a student pilot loan:

- The student should be an Indian citizen.

- The student should be between the age group of 16 to 35 while pursuing the course.

- Students must have proof of admission to the pilot training institute

- The student must meet medical requirements and pass the medical examination.

- Some flight schools may require students to pass certain entrance exams like SAT, GMAT, GRE, ACT, or specific aviation entrance exams.

Documents Required for an Education Loan for Pilot Training

| Required Documents | Description |

| Applicant and co-applicant documents | Valid identification proof documents like passport or PAN card. |

| Applicant’s academic documents | Academic documents include 10th and 12th-grade mark sheets, semester mark sheet/transcript, degree, and entrance exam scores (IELTS, TOEFL, GMAT and others) |

| Applicant’s financial documents | Financial documents include bank statements of the applicant for the last 6 months, last 3 months salary slip, last 2 years’ Form 16, last 3 years’ ITR, balance sheet and profit and loss account, and business proof |

| Proof of identity | Valid identification documents like PAN card or passport |

| Address proof | Documents that can verify the applicant’s address like passport, aadhar card, etc. |

Note: The details mentioned in the table vary by bank, company, location and currency exchange rate. Last updated on 03/05/24.

Read More : How to Pay Canada College Fees from India

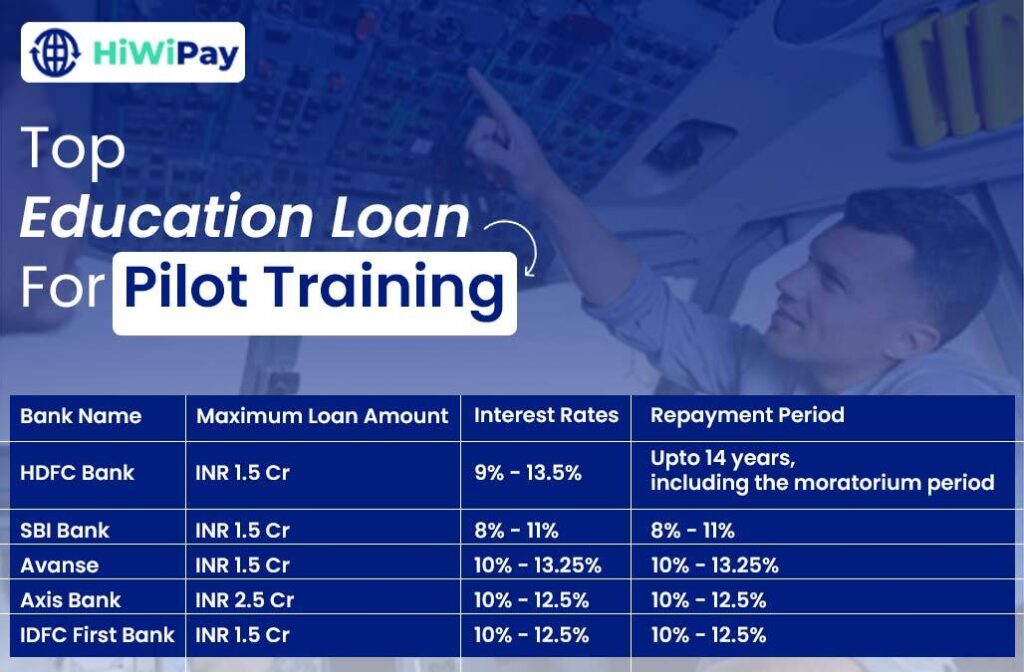

Top Education Loan Providers In India For Pilot Training

| Bank Name | Maximum Loan Amount | Interest Rates | Repayment Period |

| HDFC Bank | INR 1.5 Cr | 9% – 13.5% | Upto 14 years, including the moratorium period |

| SBI Bank | INR 1.5 Cr | 8% – 11% | Upto 15 years |

| Avanse | INR 1.5 Cr | 10% – 13.25% | Upto 15 years, including the course duration |

| Axis Bank | INR 2.5 Cr | 10% – 12.5% | Upto 10 years |

| IDFC First Bank | INR 1.5 Cr | 10% – 12.5% | Upto 15 years |

Note : Last updated on 03 May, 2024. Please note that it is always best to check with the bank for the most accurate information.

Read More : How To Avoid 20% TCS On Foreign Remittances

Benefits of Securing Overseas Education Loans from Government Banks

Choosing government banks over private ones for overseas education loans can provide you with a more financially secure and student-friendly option for pursuing education abroad. Here are the benefits government banks offer:

- Lower Interest Rates: Government banks offer loans with considerably lower interest rates compared to private lenders. This means you can save significantly over the loan term, allowing you to focus wholeheartedly on your education overseas without the financial stress of high-interest payments.

- Diverse Schemes for Targeted Support: Many government banks provide specialised loan schemes designed to assist specific demographics or academic pursuits. For instance, some banks offer interest rate concessions for girl children, while others extend lower rates for students enrolled in prestigious international universities. These targeted support initiatives make education financing more inclusive and accessible to a diverse range of students.

- Extended Moratorium Period: Government banks usually offer an extended moratorium period, which is the duration during which the borrower is not required to make any repayments. This period typically extends until the completion of the course and for a certain period thereafter, giving the student ample time to secure a job and start repaying the loan. It ranges from 6 months to a year.

These benefits make government banks a popular choice for students seeking loans for overseas education. However, it is important to carefully review the terms and conditions of the loan agreement before signing.

Education Loan For Pilot Training Requirement

Before applying for an education loan, aspiring pilots must meet certain criteria set by lenders. Here are the main points to keep in mind:

- Age Range: Typically, the Indian applicant must be between 14 and 45 years old.

- Educational Background: Applicants usually need to have completed their 10+2 education from a recognised board or equivalent.

- Admission to Accredited Aviation Institute: It is essential to have proof of admission to a recognised aviation institute offering pilot training.

- Other Considerations: Lenders may also assess factors like credit history, co-applicant income, collateral availability (for secured loans), and the amount of loan requested.

Once you have understood the requirements and if you fit within the eligibility criteria for securing the loan, follow these steps to secure a loan:

- Find the right lender: Look into different lenders, comparing their terms and reviews to find the best fit for you.

- Gather all your documents: Collect all the necessary paperwork, including your application form, ID, academic records, admission letter, training cost estimate, income proof, and any collateral documents if needed.

- Complete the application: Fill out the application form accurately and attach all the required documents.

- Wait for approval and funds: The lender will review your application, assess your credit, and verify your documents. If approved, you will receive an offer letter outlining the loan terms. Review, sign, and return it. Once everything is in order, the loan amount will be disbursed to your institute or account.

Now, when you choose your repayment plan, consider the following things:

- Grace Period: Typically, repayment begins one year after graduation or six months after securing employment, whichever occurs first. This initial period is known as the moratorium period.

- Repayment Tenure: You have a maximum of 15 years to repay the loan amount, including the 12-month moratorium period.

- EMI: Equated Monthly Installments (EMIs) are the standard repayment method. Each instalment covers both principal and interest and remains constant throughout the loan tenure.

Please note that these are general steps and may vary depending on the specific bank or financial institution offering the loan.

Expenses that will be Covered Under this Education Loan

Under an education loan for pilot training, the following expenses are typically covered:

- Tuition Fees: The loan covers the entire tuition fee charged by the flight training institute or a part of it. It can be dispersed to the university or your account.

- Living Expenses: The loan can also cover the cost of accommodation, meals, and other day-to-day expenses.

- Health Insurance: It is one of the requirements for students abroad. The cost of health insurance required during the course of study is also covered by the loan. You can even ask the university to cover it.

- Visa Fees: The fees associated with obtaining a student visa for studying abroad are covered, but only some banks or financial institutions cover them, so do check them.

- Air Ticket: The cost of travel to the country where the training is being conducted is also included, but you will have to ask for it.

- Expenses Related to Studies: This includes the cost of books, study materials, uniforms, laboratory fees, examination fees, and any other expenses directly related to the course. If it is not included, you can ask the bank to include it.

Read More : How to Save on Paypal International Fees

Important Points to Consider Before Stating Expenses for an Education Loan

When stating expenses for an education loan, it’s crucial to consider the following points because once the loan is sanctioned, you can’t change it:

- Calculate Everything: Make sure you accurately add up tuition fees, housing costs, and living expenses. This includes things like rent, food, and transportation.

- Tuition Fees: Remember that tuition fees are a big part of what you will borrow.

- Daily Living: Factor in the costs of housing, meals, and other everyday expenses.

- Extras: Don’t overlook additional expenses like health insurance, visa fees, travel, and study materials.

- Loan Limits: Check if there is a maximum amount you can borrow from your lender.

- No Changes Allowed: Once the loan process starts, you can’t change the amount you have requested or the expenses you have listed.

The Pros and Cons of Pilot Training Loans

There are several financing options available, but are they worth it? Consider the pros and cons of each one to determine this.

- Bank Loans

This is the most common way to finance pilot training . Many public and private sector banks, as well as non-banking financial companies (NBFCs) offer loans for pilot training. The interest rates usually range from 8.30% to 12%.

Pros:

- Covers tuition, flying charges, and living expenses.

- Relatively easy to qualify for.

- Repayment can start after employment.

Cons:

- Requires good credit history.

- High-interest rates may lead to significant debt.

- Repayment can strain early career earnings.

- Scholarships

These are offered by government, academies, and private organizations. Their criteria vary but typically include strong academics and aviation interests.

Pros:

- No repayment is required.

- Significantly reduces training costs.

- Offers prestige and recognition.

Cons:

- Competitive to obtain.

- Might not cover full training expenses.

- Funds may have usage restrictions.

- Grants

Similar to scholarships, grants are often for specific purposes or backgrounds. They are awarded by government and private foundations.

Pros:

- No repayment necessary.

- Can be earmarked for specific needs.

- Helps diversify the aviation industry.

Cons:

- Highly competitive to secure.

- Funds may have usage restrictions.

- Might not cover the entire training costs.

Pilot Training Institutes in Abroad

| Top 10 Pilot Training Institutes | Country | Fee Structure |

| CTC Aviation | UK | INR 63.14L to 84.18L |

| Singapore Flying College | Singapore | INR 43.76L to 93.77L |

| Aerosim Flight Academy | USA | INR 49.96L to 74.94L |

| Olympus Aviation Academy | Europe | INR 45.1L to 90.18L |

| Ardmore Flying School | New Zealand | INR 31L |

| Oxford Aviation Academy | UK | INR 19.5L to 20L |

| Western Michigan University Aviation College | USA | INR 7L to 18L |

| University of New South Wales Aviation | Australia | INR 6L |

| Ohio State University Aviation College | USA | INR 3L to 7.5L |

| United States Air Force Academy | USA | No cost. It is necessary that you serve in the U.S. Air Force or Space Force for a predetermined amount of time. |

Note: The details and numbers mentioned in the table vary by university, location and currency exchange rate. Last updated on 03/05/24.

Scholarships at the Best Flying Schools in the Abroad

Scholarships for aspiring pilots are available worldwide, making flight training more accessible to those with talent and determination. These scholarships, offered by organisations such as educational institutions and aviation associations, aim to support promising individuals in pursuing their aviation careers.

In the USA, options include the Aircraft Owners and Pilots Association (AOPA) Flight Training Scholarship, which awards up to INR 83,000 to AOPA members who have completed solo flights. Additionally, the Ninety-Nines Amelia Earhart Memorial Scholarship, also offering up to INR 83,000, is available for women pursuing aviation careers.

Similarly, in the UK, the Air League Scholarship provides opportunities for pilot training, catering to individuals aged 18 to 35. The Royal Air Force Charitable Trust also offers scholarships to young people interested in aviation careers.

Frequently Asked Questions

Can I get a loan for my pilot training?

Yes, you get a loan for my pilot training. To apply for an education loan, you’ll need to meet certain criteria such as age requirements, educational qualifications, and medical fitness standards. It covers tuition fees, travel, and other related costs.

How do you get money for pilot training?

You get money for pilot training through bank loans, scholarships, and grants. It’s important to research and compare these options to find the best fit for your financial situation and career goals.

How much do you need to invest to be a pilot?

The investment required to become a pilot can vary widely depending on the country, type of training, and the flight school. In the USA, training costs can range from $88,995 to $91,995. In the UK, the cost of becoming a pilot can be between £80,000 and £130,000.

Does SBI provide a loan for pilot training?

Yes, the State Bank of India (SBI) does provide loans for pilot training.

Maximum loan amount: INR 1.5 Cr

Interest rate: 8% – 11%

Repayment period: Upto 15 years

Are there any collateral requirements for an education loan for pilot training?

When it comes to education loans for pilot training, collateral requirements can vary depending on the lender and the amount of the loan. For larger loan amounts, most banks and financial institutions typically require some form of collateral as security. Acceptable collaterals are

1. Life Insurance Corporation Policy,

2. Fixed Deposit,

3. Government bond or

4. Immovable Property

References:

Works Cited

“6 Expenses Covered under Overseas Education Loan.” Elanloans.com, www.elanloans.com/blogs/list-of-expenses-that-are-covered-under-study-abroad-loan. Accessed 22 Apr. 2024.

“Apply Education Loan for Abroad Studies | IDFC FIRST Bank.” Www.idfcfirstbank.com, www.idfcfirstbank.com/personal-banking/loans/education-loan/education-loan-for-abroad-studies. Accessed 22 Apr. 2024.

“Apply Online in India for Studies Abroad (above Rs. 20 Lakhs) | SBI – Personal Banking.” Sbi.co.in, 2019, www.sbi.co.in/web/personal-banking/loans/education-loans/global-ed-vantage-scheme. Accessed 22 Apr. 2024.

“Best Flying Schools in the World 2024.” Leap Scholar, 13 Mar. 2024, leapscholar.com/blog/best-flying-schools-in-the-world/. Accessed 22 Apr. 2024.

Capital, Tata. “How to Finance Your Pilot Training with an Education Loan?” TATA Capital Blog, 16 Feb. 2024, www.tatacapital.com/blog/loan-for-education/how-to-finance-your-pilot-training-with-an-education-loan/. Accessed 22 Apr. 2024.

“Education Loan for Pilot Training – Eligibility and Interest Rates.” WeMakeScholars, 24 Feb. 2023, www.wemakescholars.com/education-loan/pilot-training#:~:text=The%20average%20cost%20of%20pilot%20training%20abroad%20in. Accessed 22 Apr. 2024.

“Education Loan to Study Abroad | Avanse Financial Services.” Www.avanse.com, www.avanse.com/education-loan/study-abroad-loan. Accessed 22 Apr. 2024.

“Flying School in the USA in 2024: Fees, Top Schools and More.” Leap Scholar, 30 Oct. 2023, leapscholar.com/blog/pilot-training-in-usa-for-indian-students-fees/. Accessed 22 Apr. 2024.

“Foreign Education Loan – Education Loan for Abroad Studies | HDFC Bank.” Www.hdfcbank.com, www.hdfcbank.com/personal/borrow/popular-loans/educational-loan/education-loan-for-foreign-education. Accessed 22 Apr. 2024.

“How to Get Education Loan for Abroad Studies | Axis Bank.” Www.axisbank.com, www.axisbank.com/progress-with-us-articles/education-loan-for-abroad-studies. Accessed 22 Apr. 2024.

Pahuja, Heena. “Education Loan for Pilot Training: Eligibility, Process, Documents.” Fly Finance, 5 Mar. 2024, fly.finance/blog/education-loan/education-loan-for-pilot-training/#h-eligibility-criteria-to-get-education-loan. Accessed 22 Apr. 2024.

Sonal. “Types of Education Loan for Indian Students.” Leverage Edu, 16 Mar. 2023, leverageedu.com/blog/types-of-education-loan/. Accessed 22 Apr. 2024.

“Student Loans for Pilot Training | Pilot Training Loans | Credenc.” Www.credenc.com, www.credenc.com/blog/pilot-training-loans. Accessed 22 Apr. 2024.

Talekar, Shriyansh. “The Cost of Pilot Training in India: How to Finance Your Dream of Flying.” Maverick Aviation, 1 Dec. 2023, www.maverickaviation.in/post/the-cost-of-pilot-training-in-india-how-to-finance-your-dream-of-flying. Accessed 22 Apr. 2024.

“Top Government Bank Education Loan for Studying Abroad.” Elanloans.com, www.elanloans.com/blogs/top-nationalized-government-banks-for-overseas-education-loans. Accessed 22 Apr. 2024.